A Biased View of Tax Accountant In Vancouver, Bc

Wiki Article

Some Ideas on Small Business Accounting Service In Vancouver You Should Know

Table of ContentsGet This Report about Virtual Cfo In VancouverGetting My Outsourced Cfo Services To WorkThe Ultimate Guide To Small Business Accounting Service In VancouverVancouver Tax Accounting Company Things To Know Before You Buy

Since it's their work to remain up to day with tax obligation codes and also policies, they'll have the ability to suggest you on just how much money your organization needs to place aside so there aren't any type of shocks. Prior to you freak out an audit isn't constantly negative! The feared "internal revenue service audit" happens when an organization isn't submitting their taxes correctly.

When it concerns getting ready for any type of audit, your accountant can be your friend due to the fact that they'll conserve you loads of time getting ready for the audit. To avoid your service from getting "the bad audit", below are some ideas to comply with: File and pay your tax obligations promptly Do not improperly (or forget to) data organization sales and receipts Don't report personal prices as organization expenditures Keep accurate service records Know your particular organization tax obligation reporting commitments Recommended analysis: The 8 A Lot Of Typical Tax Obligation Audit Causes Quick, Books After assessing the fundamental accounting and also accounting services, you're probably wondering whether it's something you can handle yourself or require to hand off to an expert.

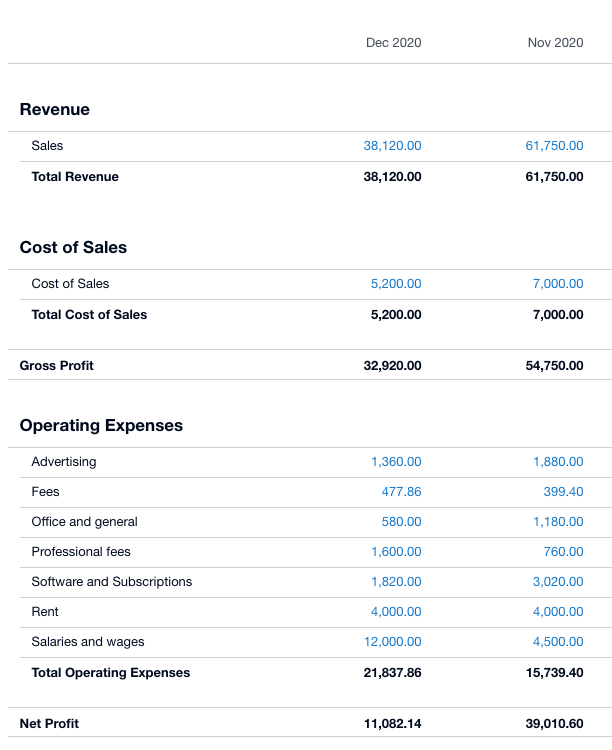

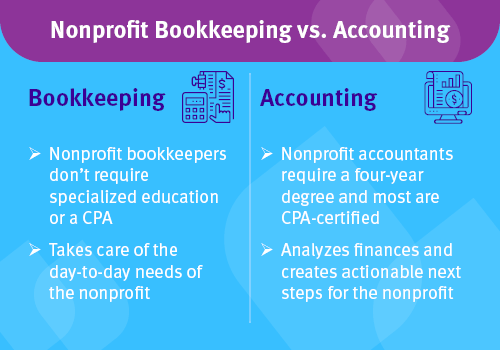

For circumstances, will you need to prepare once a week or regular monthly financial reports or just quarterly and yearly records? Another point to take into consideration is monetary knowledge. Is there somebody in your workplace that is qualified to manage vital bookkeeping and also bookkeeping services? Otherwise, an accounting professional could be your most safe wager.

Accountants are rather adaptable and can be paid hourly. In addition, if you do make a decision to outsource audit and bookkeeping solutions, you wouldn't be in charge of providing advantages like you would certainly for an in-house staff member. If you choose to hire an accounting professional or bookkeeper, right here are a few ideas on discovering the ideal one: Inspect recommendations as well as previous experience See to it the candidate is informed in bookkeeping software program as well as modern technology Ensure the prospect is well-versed in accounting plans as well as procedures Evaluate that the candidate can plainly connect economic terminology in words you recognize See to it the prospect is sociable and also not a robotic Small organization proprietors and entrepreneurs commonly contract out audit and bookkeeping solutions.

The Vancouver Accounting Firm Ideas

We compare the most effective right here: Swing vs. Zoho vs. Quick, Books Don't fail to remember to download our Financial Terms Rip Off Sheet, that includes vital bookkeeping and bookkeeping terms.

To be effective in this role, you ought to have previous experience with accounting as well as a style for identifying mathematical errors. Eventually, you will certainly offer us with accurate measurable information on economic placement, liquidity as well as capital of our my response business, while ensuring we're certified with all tax policies. Take care of all audit purchases Prepare budget plan forecasts Publish financial declarations in time Handle monthly, quarterly and yearly closings Resolve accounts payable and receivable Ensure prompt financial institution settlements Calculate tax obligations and prepare tax returns Handle annual report and profit/loss statements Report on the business's monetary health and wellness and liquidity Audit monetary purchases as well as papers Strengthen economic information discretion as well as conduct data source small business accounting services back-ups when needed Abide by monetary policies and regulations Function experience as an Accounting professional Exceptional understanding of accountancy policies and treatments, consisting of the Generally Accepted Accounting Concepts (GAAP) Hands-on experience with accountancy software application like Fresh, Books and Quick, Books Advanced MS Excel skills consisting of Vlookups as well as pivot tables Experience with general journal features Strong focus to information and excellent logical skills BSc in Audit, Financing or relevant level Additional qualification (certified public accountant or CMA) is a plus What does an Accountant do? An Accounting professional cares for all financial issues within a company, like maintaining and analyzing monetary documents - small business accountant Vancouver.

What are the responsibilities and obligations of an Accountant? The responsibilities of an Accounting professional can be rather substantial, from auditing financial documents and conducting economic audits to reconciling financial institution declarations and also determining taxes when filling in yearly returns. What makes a good Accounting professional? A great accountant is not simply a person with money skills but additionally an expert in human relations and also communication.

Who does Accounting professional deal with? Accountants web collaborate with company leaders in tiny business or with supervisors in large corporations to guarantee the quality of their monetary records. Accounting professionals might likewise team up with private group leaders to obtain and also audit economic records throughout the year.

How Tax Accountant In Vancouver, Bc can Save You Time, Stress, and Money.

The term bookkeeping is really usual, particularly throughout tax obligation season. Before we dive right into the significance of accounting in company, allow's cover the fundamentals what is accounting? Audit refers to the organized as well as detailed recording of economic purchases of a service. There are many kinds, from making up local business, government, forensic, and also management bookkeeping, to making up corporations.

Regulations as well as laws differ from one state to another, but appropriate audit systems and processes will assist you make certain legal compliance when it pertains to your business (Vancouver tax accounting company). The accounting function will ensure that responsibilities such as sales tax obligation, VAT, revenue tax obligation, and also pension funds, to call a couple of, are suitably dealt with.

Service patterns and projections are based on historic monetary data to keep your procedures successful. Organizations are called for to submit their financial statements with the Registrar of Firms.

An Unbiased View of Vancouver Tax Accounting Company

Report this wiki page